Credit Engine by Brainysoft

We offer a full range of solutions and services to run Microfinance Institution

Please leave your email to continue communication.

Tech in Fintech

- OUR CUSTOMERSMFI, Banks, Credit Union.

- ALL-INCLUSIVELaunch your lending business at minimum cost and time-to-market with our Lending as a Service Solution.

- FINTECHBuild your own marketplace, p2p payment, consumer or SME loan product, debit or prepaid card.

About Credit Engine

- Functional parts of the platform.

- Which companies need our platform.

- Licensing options.

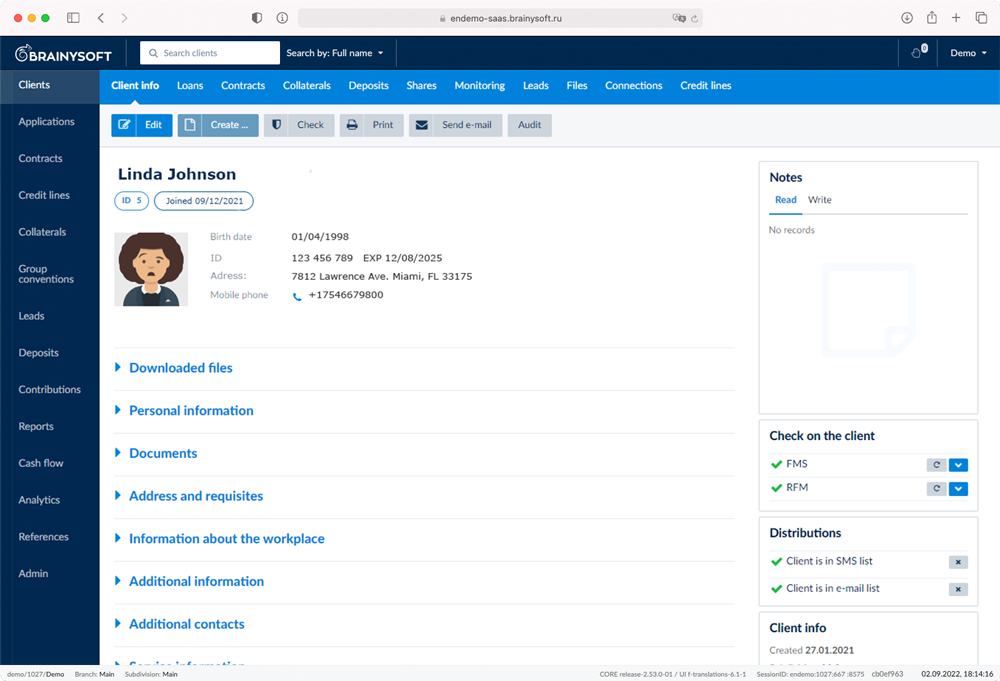

Brainysoft Platform

We are an IT partner who takes care of all technological issues for the rapid development of business in modern conditions.

In numbers

Scalability of IT gives the opportunity to increase income without a dramatic increase in costs.

1

128%

81%

50

140%

days

day

30

ONLINE

Setting up a new credit product

Customers portfolio growth

2020-2021

2020-2021

Productivity in processing new contracts on a portfolio

employees

Customers portfolio growth

2021-2022

2021-2022

Customers portfolio growth Quick Start

2020

25%

25%

2021

38%

38%

OUR CUSTOMERS

2022

67%

67%

Compliance: Fl 152 SPD RUSSIA // GDPR 2018 EU // PDP BILL 2018 INDIA

We have a strong presence in Central Asian and European markets

Currently we are expanding our business to Africa, Western Asia and India

Our products

Standard services for lending and customized products use our credit engine for business.

Lending as a Service

Buy Now Pay Later

Our customers

Car Loans

Castomized product for E-commerce

Castomized product for car loans

SaaS lending platform

Universal functionalities are built-in

Business leads can decide which products to offer.

Our product designer will help you define a new credit product with near-instant time to market.

Our product designer will help you define a new credit product with near-instant time to market.

-

Accounts & Contracts

Accounts & Contracts- Deposit, Current & Savings

- Loans

-

Lending / Loans

Lending / Loans- Consumer

- Corporate

- Mortgages

- Syndicated

- Micro

-

Customer

Customer- Onboarding

- KYC

- Scoring

- AML

-

Analytics & Reporting

Analytics & Reporting- Marketing

- Regulatory

- Forensics

- Risk

-

Accounting

Accounting- Finance

- Controlling

- Tax

-

Cards

Cards- Debit

- Credit

- Virtual

-

Extras

Extras- Collateral

- Leasing

- E-comm

Why to choose us

Everyday we work hard to make life of our customers better and happier.

Fast time-to-market for new offerings

No need to involve your IT department. Our product designer makes it easy to launch your new credit products in less than one week.

Multi-Currency on one account

(Fiat & Crypto Currency)

(Fiat & Crypto Currency)

Our digital lending as a Service solutions support multi-currency accounts seamlessly.

Reliable regulations without reconciliations

Due to its single-point-of-truth design, no internal reconciliations are required. All functional departments see the same correct amounts in real-time.

IT architecture

Licensing Options

There are several licensing options: SaaS, Revenue Share and Standalone.

The most common SaaS licensing

— monthly payment.

Cost of rent depends on the number of users. Minor and major updates are included in the license payment.

The company does not need to make large financial investments, you can test the system, work on it and then scale to the entire company.

— monthly payment.

Cost of rent depends on the number of users. Minor and major updates are included in the license payment.

The company does not need to make large financial investments, you can test the system, work on it and then scale to the entire company.

SaaS licensing — Revenue Share is when a company pays us commission from actually received incomes.

Number of users in this case doesn't matter. Minor and major updates are included in the license payments.

Number of users in this case doesn't matter. Minor and major updates are included in the license payments.

The Standalone version is a one time version buying software on client server.

Number of users in this case doesn't matter.

Version with only minor updates. And a subscription version with all updates.

Number of users in this case doesn't matter.

Version with only minor updates. And a subscription version with all updates.

Please send an application for detailed cost information.

We are looking for local partners

on international markets

FRANCHISE

- UI localization

- Third-party fintech services integrations. API

- Sales & Marketing support

Lending as a Service

P2P cryptocurrency lending marketplace

Meet our team

The smartest people work every day to provide the best service and to make our clients happy.

- Denis KrestinHead of Business Development

- Galina BakhmetevaChief Executive Officer

- Andrey ZubarevChief Technical Officer

- Vlad BereznitskiyChief Product Officer

- Anita KhasanovaHead of International Development

- Yuri VolokhonskiyAdviser

Exhibitions in which we take part

Contact us

+7 (967) 065-71-17

anita.khasanova@brainysoft.ru

Bolshoy bulvar 42, stroenie 1, office 2-216, Skolkovo Innovation Center, Tehnopark, Moscow, Russia, 121205

anita.khasanova@brainysoft.ru

Bolshoy bulvar 42, stroenie 1, office 2-216, Skolkovo Innovation Center, Tehnopark, Moscow, Russia, 121205

Фото автора Karolina Grabowska: Pexels

The research is carried out by BrainiSoft LLC with grant support from the Skolkovo Foundation